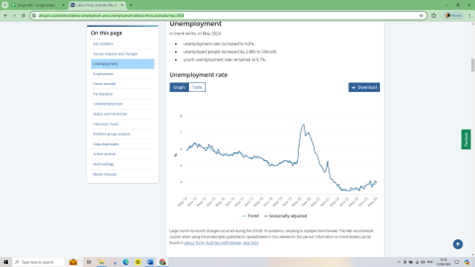

The accounting profession in Australia has been facing a shortage of skilled workers for several years. According to the Australian Bureau of Statistics, the demand for accountants has been consistently rising, with accounting roles among the top 10 in-demand occupations. They forecast that Australia will require 338,362 accountants by 2026—almost 10,000 extra a year (S.1). As of May ‘24, Australia’s overall free labour pool was at low levels, leaving little option for retraining (S.2).

Several factors contribute to this shortage:

Ageing Workforce: A significant portion of the accounting workforce is nearing retirement age, creating a gap that younger professionals are not filling quickly enough.

Migration Barriers: Changes in visa policies and reduced migration during the COVID-19 pandemic have limited the influx of international accounting professionals.

Educational Gaps: There are mismatches between the skills taught in accounting programs and the practical needs of the industry, leaving graduates underprepared for the job market.

The impacts of talent shortages upon Australian SME accountancy businesses.

The impact of the Australian accountancy talent shortage on small and medium-sized enterprise (SME) accountancy businesses affects their operations, growth, and overall sustainability. Are any of these issues familiar to you?

1. Increased Workload for Existing Staff

With fewer qualified accountants available, existing staff in SME accountancy firms are likely to experience increased workloads. This can lead to burnout, reduced job satisfaction, and potentially higher turnover rates among current employees.

2. Higher Recruitment Costs

The competition for skilled accountants drives up recruitment costs. SME accountancy firms may need to offer higher salaries, better benefits, or more incentives to attract and retain qualified professionals, impacting overall profitability.

3. Delayed Services

The shortage can result in delays in delivering services to clients due to overburdened staff. Reduced efficiency and longer turnaround times can negatively affect client satisfaction and reputation.

4. Constraints on Business Growth

The competition for skilled accountants drives up recruitment costs. SME accountancy firms may need to offer higher salaries, better benefits, or more incentives to attract and retain qualified professionals, impacting overall profitability. The inability to recruit sufficient talent may hinder the ability to take on new clients or expand services. This can limit growth opportunities and constrain the ability to scale operations.

5. Impact on Client Relationships

Strong client relationships are crucial for SME accountancy businesses. The talent shortage can strain these relationships if clients experience delays or reduced service quality, potentially leading to client attrition.

6. Increased Reliance on Temporary and Contract Workers

To cope with the talent shortage, SME accountancy firms may rely more on temporary or contract workers. While this provides flexibility, it can also lead to inconsistencies in service delivery and challenges in maintaining culture and continuity.

7. Competing with ‘bigger beasts’ for talent

The talent shortage intensifies competition among accountancy firms, not just for clients but for skilled professionals as well. SME firms may find it particularly challenging to compete with larger firms that can offer more attractive compensation packages and career opportunities.

What are the benefits of adding offshore accounting talent to your team?

Why is the Philippines becoming the outsourcing accounting capital of the world?

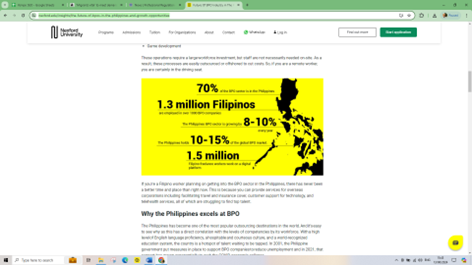

Outsourcing has emerged as a strategic response to the skills shortage. By tapping into global talent pools, businesses can access the skills they need without being constrained by local shortages. The Philippines has become a hub for outsourced accounting services due to its large pool of qualified professionals, cost-effectiveness, and strong cultural alignment with Western countries.

Why offshore accounting, Philippines talent?

Qualified Talent Pool: The Philippines produces a significant number of accounting graduates annually. The country has a robust educational system that emphasises accounting and finance, ensuring a steady supply of qualified professionals. In 2021, the Professional Regulation Commission (PRC) reported that over 11,000 candidates passed the Certified Public Accountant (CPA) licensure examination (S.3)

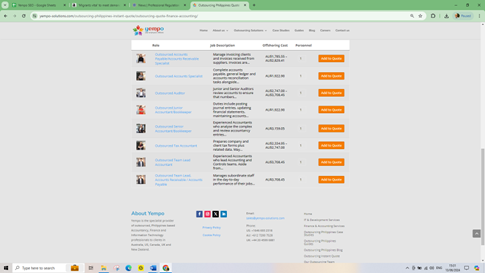

Cost-Savings: Labour costs in the Philippines are significantly lower than in Australia. According to PayScale (S. 4), the average annual salary for an accountant in the Philippines is approximately PHP 300,000 (around AUD 8,000), compared to AUD 70,000 for an accountant in Australia.

How would you invest salary savings like these? The real benefits go far beyond simple cost savings. Calculate what these can be for your business using our ready reckoner guide on the huge financial advantages of outsourcing your accountancy functions to the Philippines.

Get an instant quote.

“Yempo’s fully integrated model means they are an extension of our local team. Our clients don’t know the difference. Cost is simply an added benefit.’’ – Simon J, Director, SDJA Accountants

Cultural Compatibility: The Philippines is highly proficient in English and has a strong cultural affinity with Western countries. This compatibility reduces the friction that can occur in communication and collaboration, making it easier to integrate Filipino accountants into Australian business processes.

The Accountancy Outsourcing Landscape in the Philippines

The outsourcing industry in the Philippines has seen exponential growth over the past decade, with the Business Process Outsourcing (BPO) sector playing a pivotal role in the country’s economy. In 2023, the Philippines BPO industry contributed nearly $30 billion to the economy and employed over 1.3 million people (S. 5). Accounting services represent a significant segment of this industry, with many firms, like Yempo, specialising in providing financial and accounting services to international clients.

Comprehensive Recruitment and Vetting

The best specialist accounting outsourcing firms in the Philippines, including Yempo, employ rigorous recruitment processes to ensure that only the most qualified and experienced accountants are selected. This includes multiple rounds of interviews that clients are fully involved in, skills assessments, and background checks. By doing so, firms guarantee that their clients receive top-tier talent capable of meeting complex accounting needs.

‘’ Yempo has very genuine leadership with structured processes. They recruit for us based on our projected demand. Others have a ‘bench’ type talent arrangement that means they cannot always meet demand.’’ – Kirsten, CEO, Accounting for Good

Customised Solutions

Understanding that each business has unique requirements, specialists like Yempo offer tailored solutions that align with specific client needs. Whether a company requires full-time, part-time, or project-based accounting services, these firms can provide the right professionals to match these demands.

Seamless Integration

Outsourcing firms (especially Yempo) place a strong emphasis on integrating team members with clients’ existing processes and cultures. This includes training programs, regular communication channels, and ongoing support to ensure a seamless transition and collaboration. By fostering a cohesive working relationship, these firms ensure that the outsourced team operates as an extension of the client’s in-house staff.

Technology and Security

With the increasing importance of data security, outsourcing providers in the Philippines invest heavily in technology and infrastructure to protect client information. Advanced cybersecurity measures, secure communication platforms, and compliance with international data protection standards are integral to their operations. This focus on security provides peace of mind to clients, ensuring their financial data is handled with the utmost care.

‘’Yempo gives us a dedicated, reliable, consistent team with a great work ethic that’s looked after well. English skills are excellent. Incoming calls to our Perth number are answered by anyone in our team – Australia and Philippines – and customers can’t tell the difference.’’ – Andrea, Chief Financial Officer, PowerTech

Summary

The accounting skills shortage in Australia presents a significant challenge for businesses, but it also opens the door to innovative solutions like outsourcing. By partnering with outsourcing firms in the Philippines, like Yempo, Australian companies can access a wealth of remote employee accounting and finance talent, ensuring their financial operations remain robust and efficient. This strategic move not only addresses the immediate skills gap but also positions businesses for sustainable growth and success in a competitive market.

Add talent to your team today.

Thank you for visiting our blog! We hope you found our content informative and engaging. Stay connected with us for more insightful blogs, updates, and tips on outsourcing IT & outsourcing Finance in the Philippines, or shoot us an email at [email protected]. We are happy to answer your questions!

Learn more

Find & cost the IT talent you need

Explore your aims with CEO Michelle Fiegehen

Download our Step-by-step Finance Outsourcing Guide